When the stock market is in a bull market and most stocks are going up, it is much easier to pick stock winners. However, when the economic environment is bad, and not conducive to stocks going up, it is called a ‘stock pickers’ market. What this fails to mention is that most people are really bad at stock picking, let alone also knowing the ‘right’ price to buy a stock. I am likely the ‘pickiest’ stock picker in the world. I feel that only a microscopic amount of public companies’ stocks are investable. In fact, this number would be far less than 1% of all publicly traded stocks. Go take a walk down your grocery store aisles - 95% of the food is unhealthy for you. Same with most stocks in the stock market. Most stocks are bad investments. I proved this in the same-named chapter 12 in my book Across The Street From Wall Street. So, the key is to focus – focusing on only the very BEST stocks that meet certain criteria. In this article, I will be doing a ‘Deep Dive’ on a stock. I’m using this article to give potential subscribers a taste of what you can expect with my weekly newsletter.

With my Substack newsletter here, I’m looking to build a private community of educated and enthused stock investors. Please don’t be shy about sharing this newsletter link with your friends/family. This newsletter is predicated on that you should have already read my stock investing book; Across The Street From Wall Street. This will ‘level you up.’ I’ve not only been playing this ‘game’ of stock investing for a long time, but I’m also interacting with people on or close to Wall Street on a regular basis.

Being a ‘picky’ stock picker is only half of the equation, because maybe you just don’t pick the stock-maybe you also let the stock come to you. You have all the tools at your disposal, but you must ultimately get confirmation from the stock. More specifically, the stock’s chart. Let the stock come to you. How will you know it’s time? The stock will tell you. You get confirmation from looking at the stock’s chart, which is the stock’s price. It’s not just about being a ‘picky’ stock picker; it’s also about reading the stock’s chart. Let’s dig in.

This is a process of weeding out stocks that are not even worthy of your money. Then, each stock that you think could be a good investment must be confirmed by the stock’s chart, because when you buy a stock, you are also buying its stock chart. If you sit back and think about it, a stock’s price is simply the opinion of everyone in the world that bought or sold the stock. Keep in mind, people OFTEN change their opinion about a lot of things in life. But the price you buy a stock at is the MOST important thing. It gives you a ‘margin of safety’ if things go bad, and at some point, things will definitely go bad in the stock market.

How can you analyze a stock? That’s easy; Chapter 8 in my book called: How To Analyze A Stock In 7 Minutes, is dedicated just to this and walks you through exactly what to look for. We will be using a lot of the metrics explained there in the stock I’m analyzing here in this article.

What will you get with my monthly Newsletter subscription? I will do all this for you. I’ll give out a weekly ‘watchlist’ of stocks that I’m looking at. I’m always in a constant state of looking at stocks. This list may or may not change on a weekly basis. In a bear market my watchlist will be small and, conversely, in a bull market my watchlist will be bigger. I can teach you to ‘fish’ or you can have me ‘fish’ for you; or you can do a combination of both. There is no ‘right’ answer, only what you want to do.

This newsletter is set to switch over to paid on 9/30/2025; so, you have some time to take a peek at my Substack website and see what you are getting. Keep in mind, I will also be putting out a few FREE articles a year and anyone can view these for FREE. It is also imperative that you follow me on Twitter(X) because I also host a FREE stock investing show once or twice a year called Day Trader Meets Night Trader. You will learn A LOT about stock investing/trading from that show. I also have another show on Twitter (X) where I host one or two other stock investing book authors a year. These shows are also FREE and are extremely educational and worthwhile.

Deep Dive on Opera (OPRA) stock

Now, let’s get started analyzing Opera stock (ticker: OPRA, sector: Information technology) Opera Ltd. was founded in 1995, headquartered in Norway, and engages in the provision of web browsers. Its products include Opera browser for Windows, iOS, and Linux computers, as well as the mobile apps Opera for Android, Opera Mini, Opera Touch, and Opera News. The browser, which also includes the company's "Aria" artificial intelligence, boasts nearly 300 million active users across more than 180 countries worldwide. In addition to its browser, it also has e-commerce and online advertising, operates an AI-powered news discovery and aggregation service, and it owns gaming development platform GameMaker Studio. The company also recently announced Opera Neon, a new agentic browser that rethinks the role of the browser in the coming generation of the AI agentic web. This gives users the opportunity to automate routine web tasks (like filling forms, making hotel bookings, and even shopping), and have the browser do them by understanding and interacting with the content of web pages. A market capitalization between $300 million and $2 billion places OPRA in the small capitalization category. Market value: $1.4 billion. Aria artificial intelligence is the AI assistant integrated into Opera browsers, designed to enhance user experience with advanced real-time capabilities. Opera is even venturing into crypto with its MiniPay. MiniPay represents Opera’s strategic expansion beyond browsers into financial services, leveraging blockchain technology to enable accessible and affordable digital financial tools worldwide.

The term Deep Dive in regards to stock investing is a bit misleading. In my opinion, certain stocks are ‘easy’ to analyze (for example, an energy drink company), and others require much more depth of research. Keep in mind, you might not need to go that ‘deep.’ Opera stock in my opinion, does require a Deep Dive due to the technical nature of their business.

Fundamentals

Let’s take a look at the fundamentals of Opera.

52-week low is around $12 and the high $22. The stock currently trades at around $18, which is almost exactly to the penny the same as it 50-day and 200-day moving averages.

Obviously, the stock has delivered outsized returns the past 3 years as evidenced here:

P/E ratio 23 and Forward P/E: 13. OPRA's forward P/E is almost half that of the technology sector.

PEG ratio sits at 1.25 which is reasonable.

P/S ratio sits at 2.92 which in my opinion is kind of high

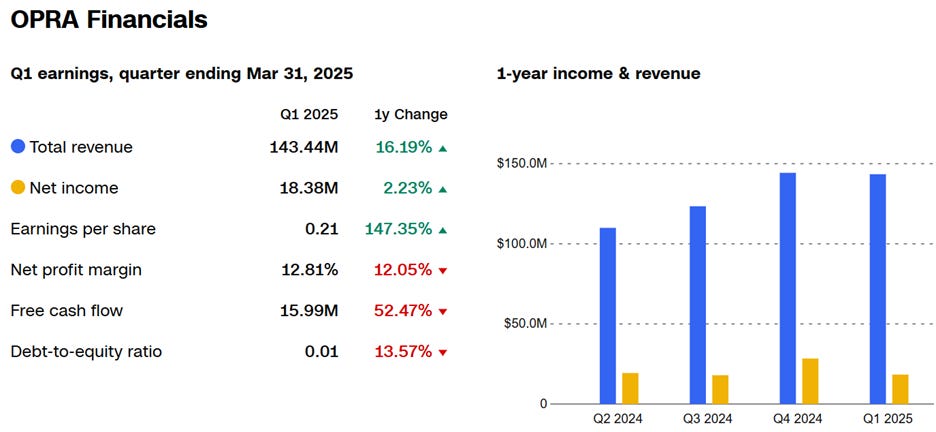

Is the company profitable? Yes, as evidenced below:

Institutional ownership – this is a problem as only about 17% institutional ownership. Around 69% of Opera is owned by a single public company, Kunlun Tech Co., Ltd (China), which has majority control over Opera. This dominant ownership limits the free float of Opera shares available.

Gross Margin = 50% which is very respectable

Short float = <3% (negligible)

Beta = .89 This is good because it shows the stock has even less volatility than the SP500 benchmark index of 1.0

OPRA stock currently has an annual dividend yield of 5.0%, which is very good. The dividend, combined with the stock’s massive growth, makes it attractive. With Opera’s massive growth the past 3 years, can certainly say the stock is a dividend growth stock.

Long term debt = microscopic. The company has very little debt, and a decent cash position.

Technical Analysis

Technical analysis (examining Opera’s stock chart) will confirm whether Opera stock is a buy right now.

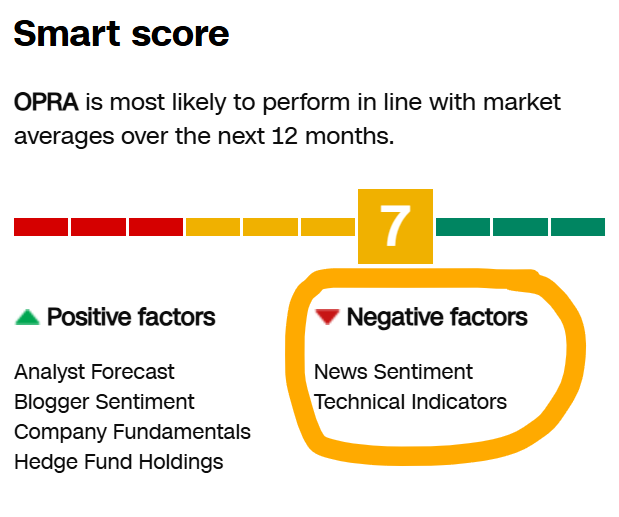

Stage 3 is a cautionary phase for investors, as it suggests a potential downtrend (Stage 4) could be on the horizon.

More caution can be warranted by looking at this graphic, which show the ‘Technical’ worries about the stock.

Trading in the bottom of its channel, after a massive stock drop from $20 down to $15. One could also infer this chart shows a buying opportunity for Opera stock now as it appears to have a ‘double bottom’ which is bullish.

Conclusion

Most everything looks great about Opera…except its stock chart, which happens to be the most important thing because it also reflects its price. Buying a stock at the ‘right’ price gives a margin of safety, should the stock ever correct down badly. Stocks never go down, right? Since technical analysis is not a science, though, one could also interpret Opera’s stock chart as having bottomed out. So, there is that to consider. As I previously discussed a few paragraphs back, their only 17% low retail ownership bothers me as well. Opera's main competitors in the web browser market include Google Chrome, Mozilla Firefox, Microsoft Edge, Apple Safari, and Brave. This is a very formidable list of competitors. However, there is a piece of possible good news here. In my opinion, Opera could get an acquisition offer from one of the top AI players. This is pure speculation, but the robustness of AI in their web browsers makes them attractive.

Opera stock has been resilient the past 3 years. What do the stock analysts think about Opera stock? Every analyst sees the stock as a Buy.

"We view [management's] focus on driving growth in its Western user base positively, as it drives higher monetization and revenue and positions the business for sustained share gains in the ad market," says B. Riley Securities analyst Naved Khan, who rates the stock a Buy. I mostly think analyst price targets are worthless. However, I would caveat this that I only mean if you are looking at individual analyst price targets for a stock. But if 20 analysts, for example, cover a stock and 18 of those analysts have a BUY on the stock then I go with the consensus thinking because the odds are much higher if you consider the entirety of the group of stock analysts. In that case, it just comes down to ‘math.’ So, in conclusion, even though I am right on the fence, I would consider Opera stock a HOLD at this time. I would look to see that the price stabilizes around its $18 key moving averages. I think you can buy it at or near that $18 and if you can get it a bit cheaper that might be good too. In my opinion, the main reasons to BUY would be: they’re growing, profitable, current stock price in line with its key moving averages, momentum, stock could be a bit undervalued, possible acquisition target, their commitment to AI, and the mostly consensus bullishness among all their stock analysts. I hope you enjoyed this article. Thank you for reading and supporting me.

⚠️DISCLAIMER ⚠️Please note that the information contained herein is for general information and educational purposes ONLY and does not constitute investment advice or a recommendation to buy or sell any security. This service is not intended to constitute legal, tax, accounting, or investment advice. This newsletter contains my opinions and observations only. I am not a financial advisor. I am not God, or stock Jesus - and I’m very bad at accurately trying to predict the future. It should not be relied upon as the basis for any investment decision. You are responsible for you own decisions and the content provided here does not serve as personalized financial guidance from a qualified professional who has full knowledge of the specifics and context of your unique circumstances.

Not worried about it. Stock go up.

This is amazing insight DG, I love it!

I am learning how to fish from you and at the same time I'm learning how to fish on my own aswell. A combination of both as you described. You're trading TA techniques are truly unparalleled, Great value stock picks with high valuation for more potential growth, Slow constant growth is the name of the game which i admire greatly.